On 10 May 2023 we made the following changes:

Within this page, we’ve presented a helpful summary about each change.

Please refer to the updated Investment Guide for more information about all your investment options.

The Trustee has designed three Lifestyle Profiles as ‘whole of working life’ ready-made strategies if you wish to have no involvement in choosing your own investment strategy.

When your investments move

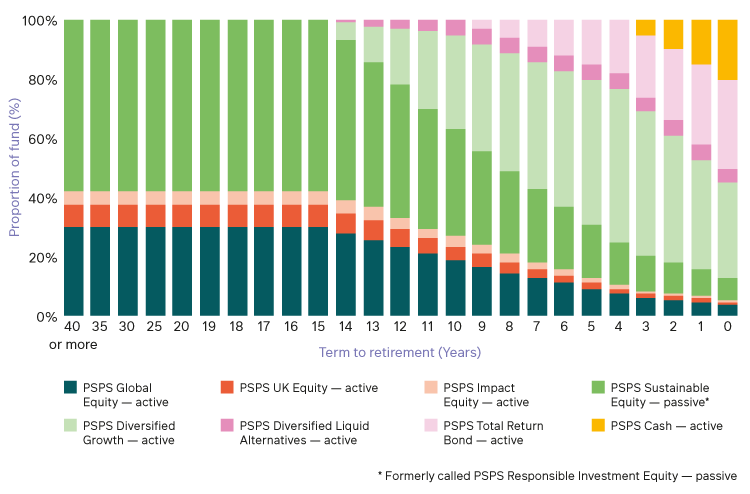

It initially invests in equities, which are generally higher risk investments, and then progressively switches into a lower risk, more diverse portfolio as you get closer to your Selected Retirement Age (SRA).

We’ve changed the period over which this switching takes place. Previously the switching would start from when you’re 20 years from your SRA, but since 10 May 2023, we’ve delayed the transition so investments will remain in equities until you’re 15 years from your SRA.

Higher risk investments are more volatile but are expected to produce higher returns in the long-term. However, lower risk investments usually result in more stable returns — a desirable outcome as you approach your SRA. It’s all a matter of timing!

We believe that starting the transition 15 years before your SRA will still provide the safety net of stable returns at lower risk, as you approach retirement.

Increased the focus on sustainable investment

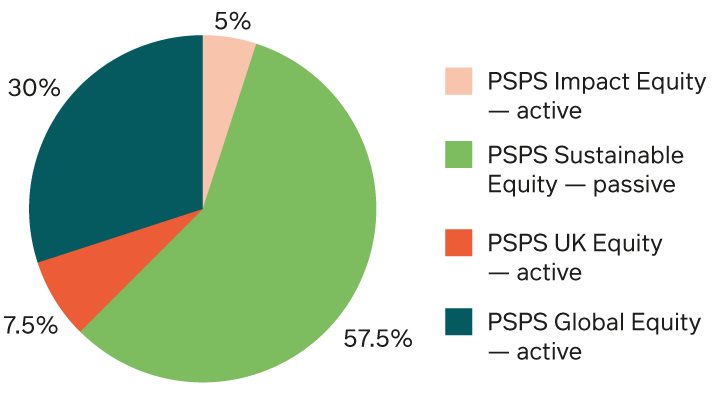

In 2020 we added the PSPS Responsible Investment Equities – passive fund to the PSPS Multi-asset Lifestyle Profile. At that time 5% of the total equity allocation was invested in this fund.

We’ve renamed this fund as PSPS Sustainable Equity – passive, and at the same time increased the proportion of the overall equity allocation invested in it to 57.5%.

The Equity allocation for the PSPS Multi-asset Lifestyle Profile:

In addition to the PSPS Multi-asset Lifestyle Profile option, there were two alternative Lifestyle Profiles you could choose from called Passive Lifestyle Profile and Active Lifestyle Profile. These options have been replaced with two new Lifestyle Profiles.

New Lifestyle Profiles

The Trustee has also designed the new Profiles as ‘whole of working life’ strategies for members who wish to have no involvement in choosing their own investment strategy, but also know how they wish to use their Personal Account in retirement.

Similar to the PSPS Multi-asset Lifestyle Profile, from around 15 years before your SRA you’ll see a gradual adjustment to your investment strategy to favour lower risk funds. This approach is expected to enable you to benefit from the expected higher investment returns provided by higher risk funds early on, then trading some of these expected returns for greater stability as you approach retirement.

This Lifestyle Profile is designed for members who know they’ll use their Personal Account to fund one or more cash sums at retirement.

Designed for members who know they’ll use their Personal Account to buy an annuity policy (or similar) to provide a regular fixed income in retirement.

Previous Lifestyle Profiles

The previous alternative Lifestyle Profiles (Passive Lifestyle Profile and Active Lifestyle Profile) will no longer be available to choose as an alternative investment option as of 10 May 2023. However if you’re already investing in one of these, unless you choose otherwise, you’ll continue to be invested in your current strategy. If you do not wish to switch to one of the other investment options available to you, you can remain where you are. Please note, they have been renamed to: PSPS Passive Lifestyle – Annuity at Retirement and PSPS Active Lifestyle – Annuity at Retirement.

If you like to have more involvement in choosing your own investment strategy, you can choose to invest in one or more bespoke funds under the Self-Select option.

We’ve added three new funds to choose from, bringing the total number of Self-Select funds to eighteen. The new funds are:

Investing entirely in the Wellington Global Impact Fund which aims to generate a financial return alongside a positive measurable societal and environmental impact.

The Annual Management Charge (AMC) will be 0.79% p.a.

Investing entirely in the Appointing Fulcrum Diversified Liquid Alternatives Fund, an unconstrained, liquid portfolio investing across Real Assets, Alternative Credit and Diversifiers.

The AMC will be 0.80% p.a.

Investing entirely in the HSBC Islamic Global Equity Index Fund, which meets Islamic investment principles as interpreted and laid down by HSBC’s Shariah Supervisory Committee.

The AMC will be 0.35% p.a.

More information about all the Self-Select funds can be found on the website and in the updated Investment Guide. The new fund factsheets will be available later this year.

Each of the PSPS investment funds is a bespoke fund created for members of the DC Section. As such, the assets are invested with one or more underlying investment funds. We’ve made several changes to these underlying investment funds to better fit the overall investment strategy:

Previously, this fund invested entirely in the LGIM Ethical Global Equity Index Fund. Now it invests entirely in the LGIM Future World Global Equity Index Fund.

We’ve renamed this fund PSPS Sustainable Equity – passive.

The AMC has reduced from 0.35% p.a. to 0.26% p.a.

We’ve replaced KBI ACWI with LGIM RAFI Fundamental Global Reduced Carbon Pathway Equity Index Fund. The fund will continue to invest in the other two underlying investment funds. The ratio of investment across the three underlying funds is:

The AMC has reduced from 0.64% p.a. to 0.55% p.a.

Nordea Diversified Return Fund has replaced Invesco GTRS. The ratio of investment will be split equally across the three underlying funds:

The AMC has increased from 0.45% p.a. to 0.47% p.a.

We’ve removed GW&K Trilogy Emerging Markets Fund. As a result, this fund now invests entirely in the RBC Emerging Markets Equity Fund.

The AMC remains at 1.00% p.a.

We’ve replaced the M&G Oversea Equity Passive Fund with a new combination of funds:

The AMC has reduced from 0.15% to 0.05% p.a.

Whether you want to check your current investment holding, check your current pension value, change your investment strategy, update your contact details or your Expression of Wish information, the quickest and simplest way to do this is online.

Access your Personal Account through the Scheme website: www.prudentialstaffps.co.uk. Scroll down to ‘How do I …’ and then ‘Access my Personal Account’.

We’ve added some Q&As to questions we anticipate you may have. Keep checking as we’ll add to them if we receive any feedback and think it might be helpful to you.

DISCLAIMER: The purpose of this video presentation is not to provide tax or financial advice. The Trustee of the Prudential Staff Pension Scheme is legally prevented from giving financial advice. This video presentation aims to help you better understand certain aspects of your pension scheme and the choices you may have. All benefits from the Prudential Staff Pension Scheme are payable in accordance with the Trust Deed and Rules, the legal document governing the Scheme. In the unlikely event of any discrepancy between any information provided to you in this presentation and the Trust Deed and Rules, the Trust Deed and Rules will prevail.

Viewing the online learning modules remotely through Citrix Access Gateway may affect the video quality. You may avoid this by viewing them directly from the Internet.